As American soccer grows in popularity, private equity and big money are stepping onto the pitch and changing the game forever.

The New Era of Soccer Investment

Soccer in the United States is no longer just a grassroots sport played in suburban parks and high school fields. Today, it’s becoming a multi-billion-dollar industry, catching the attention of investors from Wall Street to Silicon Valley. The influx of private equity and big money has transformed not only Major League Soccer (MLS), but also the structure and ambition of lower-tier leagues, youth development systems, and even broadcasting deals.

This transformation is part of a global trend where financial institutions and venture capital firms recognize the untapped potential of soccer in the U.S. market. With its massive youth participation rates, a growing immigrant population with soccer heritage, and a maturing domestic league, the United States represents a golden opportunity for return on investment—both financially and culturally.

Private Equity’s Footprint in MLS and Beyond

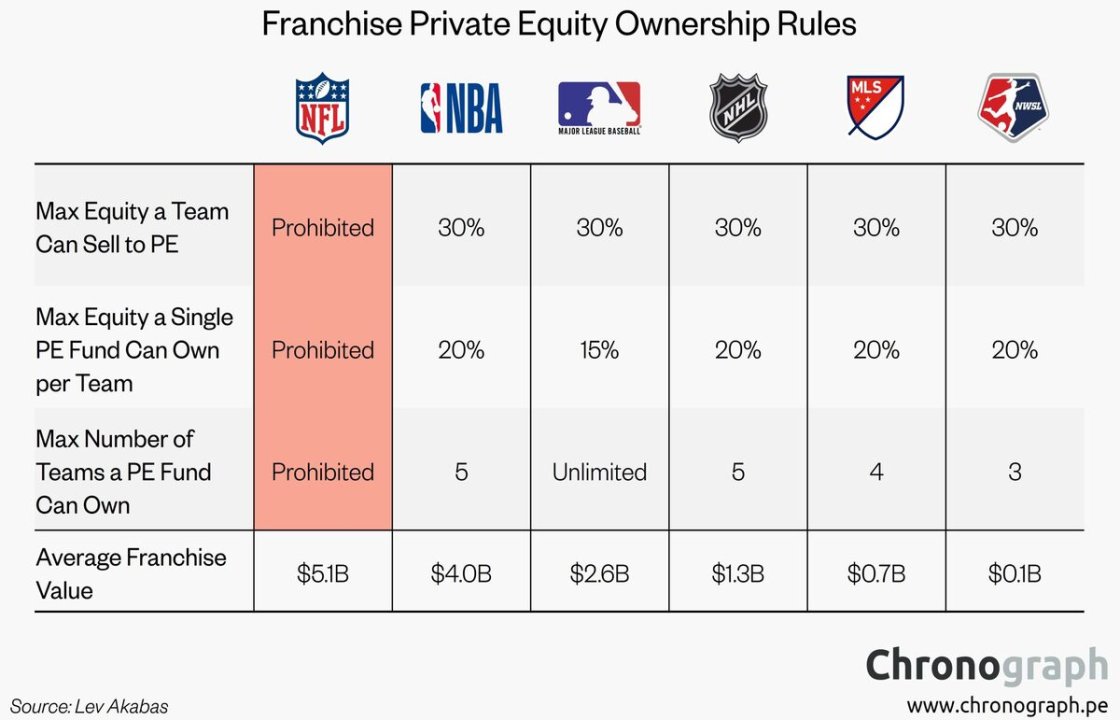

Historically, sports franchises in the U.S. were owned by passionate individuals or families with deep local ties. But in recent years, private equity firms have taken center stage, reshaping that traditional model. In 2021, MLS changed its ownership rules to allow institutional investors to buy stakes in clubs. This groundbreaking shift opened the floodgates for investment groups to get involved in a sport that had, until then, been financially conservative.

Firms like RedBird Capital, Silver Lake, and Arctos Sports Partners are now actively investing in soccer-related assets. RedBird, for example, has connections with European giants like AC Milan and Toulouse, and its U.S. presence is steadily growing. These investors bring financial muscle, sophisticated business operations, and global networks that can accelerate the commercial success of American soccer.

But it’s not just about pouring money into clubs. Private equity is also investing in media rights, sports technology startups, and fan engagement platforms. The goal is to create an ecosystem where every touchpoint—on the pitch and off—generates revenue.

The Pros and Cons of Big Money in Soccer

There’s no doubt that increased funding has improved infrastructure, training facilities, and recruitment. Clubs now have the resources to build world-class academies, sign better talent, and compete in international tournaments. For fans, this means higher-quality matches, more exciting signings, and a better viewing experience.

However, the rise of big money in U.S. soccer also brings concerns. One major issue is the potential for commercialization to overshadow community. When profit becomes the driving motive, local traditions, loyal fan bases, and grassroots initiatives may take a backseat. This is a worry for purists who fear that American soccer could lose its authenticity in the race for capital.

Moreover, there is concern about the lack of promotion and relegation in U.S. soccer. Private investors often prefer stable and predictable revenue, which the current closed-league system provides. This could inhibit the type of competitive meritocracy that fans of global soccer expect, where clubs can rise or fall based on performance alone.

The Growing Influence of Celebrity and Tech Money

The impact of celebrity ownership is another layer of this evolving story. Actors like Ryan Reynolds and Rob McElhenney have famously invested in Welsh club Wrexham, generating enormous publicity and fan engagement. In the U.S., stars like Matthew McConaughey (Austin FC) and Patrick Mahomes (Sporting Kansas City) have put their weight behind MLS teams.

Beyond celebrities, tech billionaires and venture capitalists are entering the scene, attracted by soccer's growing appeal among younger, tech-savvy audiences. Their investment is often accompanied by a vision of digital innovation, including crypto sponsorships, NFT-based fan tokens, and AI-enhanced analytics. These advancements are changing not just how teams operate, but also how fans interact with the sport.

Women’s Soccer: A Rising Investment Opportunity

While men's soccer attracts the lion’s share of investment, the National Women’s Soccer League (NWSL) is increasingly seen as a high-growth asset. In 2022 and 2023, record-breaking sponsorships and media deals were signed, and new franchises were launched with record valuations. Angel City FC in Los Angeles, backed by a star-studded group of investors, is often cited as a model for how women’s teams can achieve both social impact and profitability.

Private equity firms have noticed the trend and are beginning to explore investments in women’s soccer as well. With rising attendance, expanded TV coverage, and growing youth participation, the women's game is no longer a side story—it’s becoming central to the soccer narrative in America.

What Does This Mean for the Future?

As we look ahead to the 2026 FIFA World Cup hosted in North America, the role of private equity and big money will only grow stronger. The event is expected to supercharge the sport’s popularity and bring in a wave of international attention. This creates an unprecedented opportunity for clubs, brands, and investors alike to shape the next era of American soccer.

However, for this boom to be sustainable, the sport must strike a balance between profit and purpose. Stakeholders must remember that at its core, soccer is about passion, community, and development. If big money is used wisely, it can be the fuel that propels U.S. soccer into the global elite. If not, it risks alienating the very fans who made the sport worth investing in.

Connecting the Dots with SIA Academy

At SIA Academy, and particularly through our new Next Gen Pro Soccer initiative, we are directly connected to the changing landscape of global soccer investment. Our academy represents exactly the kind of player development pipeline that investors now seek to tap into. With young talent increasingly in the spotlight, we provide athletes with professional-level training, international exposure, and a pathway to elite clubs—making them ideal prospects for scouts and teams seeking ROI on future stars.

The rising presence of private equity in U.S. soccer also underscores the value of structured development programs like ours. While big money can build stadiums and fund clubs, it is institutions like SIA Academy that build players, leaders, and the future of the sport. We prepare our athletes not just to succeed in the changing soccer economy, but to thrive in it, bridging the gap between grassroots passion and professional ambition.